The April real estate numbers are in for the Greater Toronto Area, revealing another double-digit plunge for sale and prices, compared to the same time last year. Activity in the region has fallen 31.1 per cent with 7,792 homes sold, prompting prices to soften 12.4 per cent to an average of $804,584.

This slower sales and price appreciation is in sharp contrast to the red-hot conditions that defined the spring 2017 real estate market, before the province stepped in with the Fair Housing Plan. The 16-part set of measures was designed to cool the Greater Golden Horseshoe, including regions such as Mississauga, Brampton and the Hamilton real estate market, as well as the City of Toronto.

The result has been a dramatic downturn throughout the markets tracked by TREB, though the real estate board says growth will become more apparent once the market moves beyond the FHP’s initial impact.

“The comparison of this year’s sales and price figures to last year’s record peak masks the fact that market conditions should support moderate increases in home prices as we move through the second half of the year, particularly for condominium apartments and higher density home types,” says Jason Mercer, TREB’s director of market analysis. “Once we are past the current policy-based volatility, homeowners should expect to see the resumption of a moderate and sustained pace of price growth in line with a strong local economy and steady population growth.”

Fewer Luxury Homes Sold

As well, the mix of homes being sold has shifted; fewer sales in the luxury segment have contributed to lower overall prices, with homes priced at $2 million and over accounting for 5.5 per cent of all detached sales, compared to 10 per cent in April 2017.

TREB President Tim Syrianos also reiterates that, from a historical perspective, the GTA market has seen strong appreciation, with the necessary market fundamentals in place to support future growth.

“While average selling prices have not climbed back to last year’s record peak, April’s price level represents a substantial gain over the last decade,” he says. “Recent polling conducted for TREB by Ipsos tells us that the great majority of buyers are purchasing a home within which to live. This means buyers are treating home ownership as a long-term investment. A strong and diverse labour market and continued population growth based on immigration should continue to underpin long-term home price appreciation.”

Balance Prevails in TREB Region

A positive impact from the FHP is the return to balanced conditions for most of TREB’s market, from the searing sellers’ conditions that were rampant last spring. However, the City of Toronto is steadily creeping back to sellers’ territory with a sales-to-new listings ratio of 58.3 per cent. This ratio is calculated by dividing the number of sales by the number of new listings over a certain time period, in a specific region. According to the Canadian Real Estate Association, a ratio between 40 & 60 per cent indicates a balanced market, with below and above that threshold revealing buyers’ and sellers’ conditions, respectively. Halton region remains balanced at 47 per cent, further cementing it as a destination for affordable houses for sale in Hamilton for priced-out Toronto buyers.

Peel and Durham also remain in balanced territory at 52 and 48 per cents & however, York and Simcoe regions & the hardest hit in terms of sales and price declines following the FHP & remain firmly buyers’ markets, with ratios at 32 and 34 per cent, respectively.

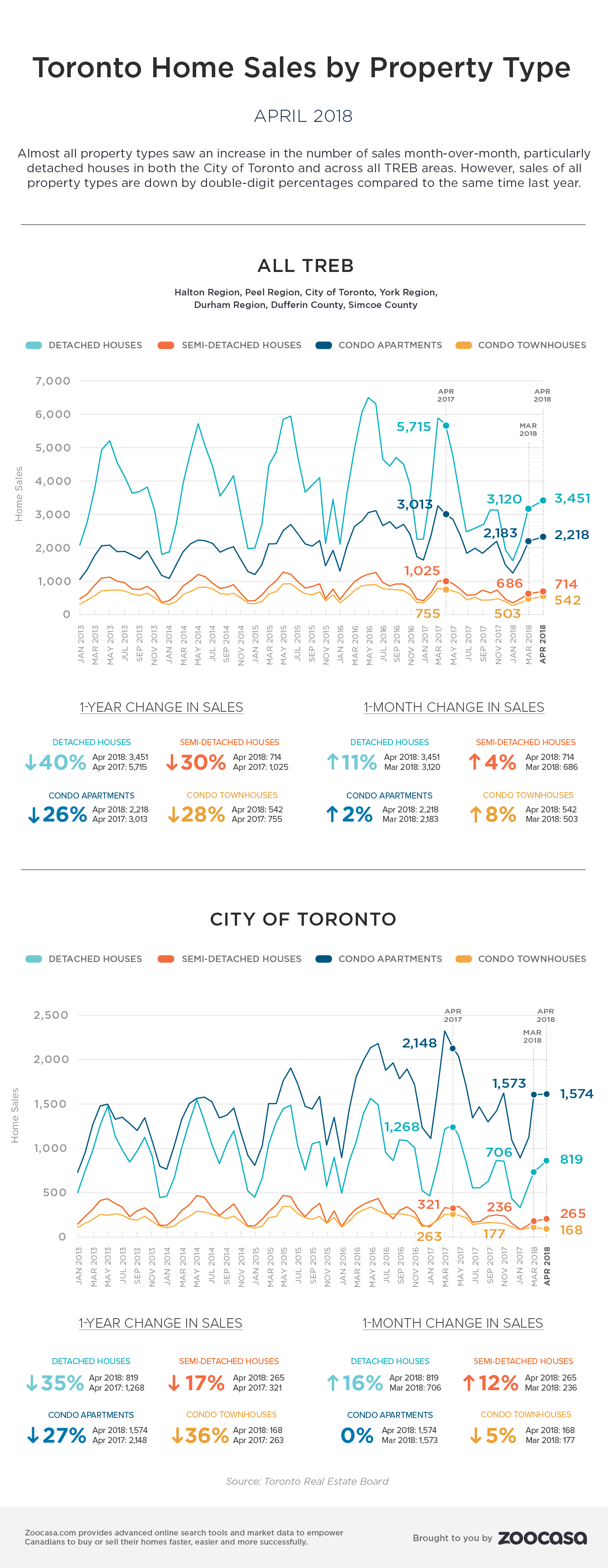

Check out the infographic below to see year-over—year and month-over-month April sales trends for the City of Toronto and Greater Toronto Area: