By: Zoocasa

Housing prices in major Canadian cities have skyrocketed in recent years. First-time home buyers have found it increasingly challenging to get a foothold on the property ladder.

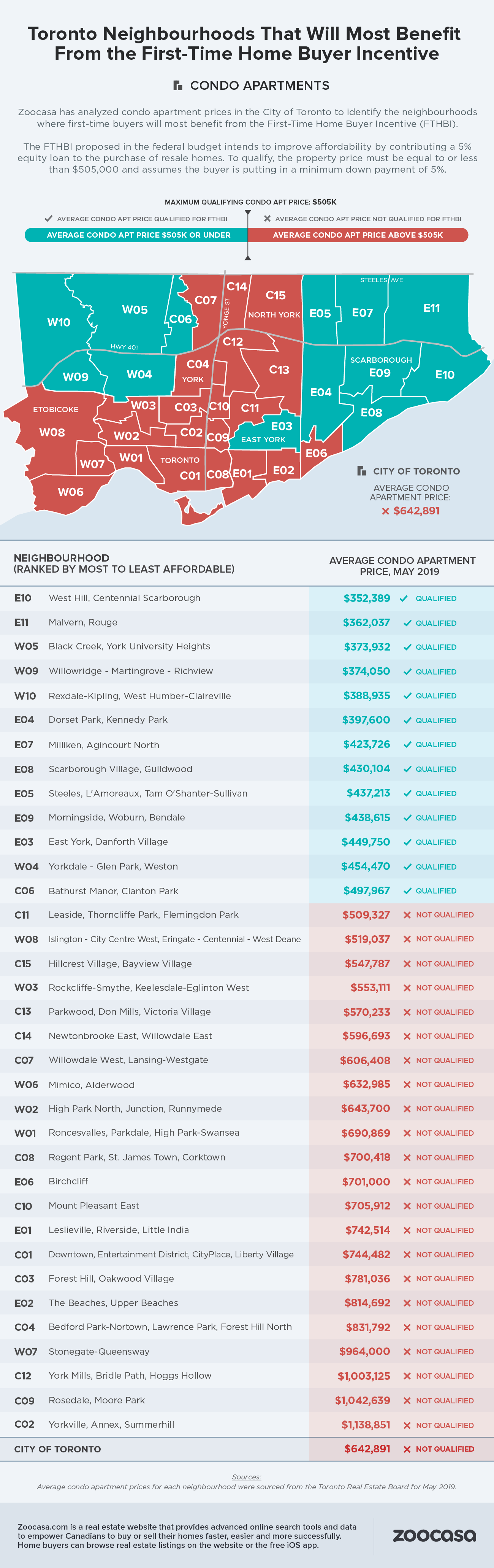

Sold house prices in Toronto have climbed to an incredible $1.3 million. An alternative used to be for first-time buyers to purchase a smaller, less expensive property type, such as an apartment. But now even that option is increasingly out of reach for most. Condos for sale in downtown Toronto now go for over $600,000 and in some popular neighbourhoods, like Liberty Village condos for sale, units are going for over $700,000. The situation is similar in the Vancouver market.

Buyers are even finding it hard to leave the major cities for smaller, cheaper markets. Unfortunately, few smaller cities offer sufficient job opportunities for that to be a realistic option. Canada’s population is simply too low and spread out to support multiple, robust economic landscapes. In addition, spillover from the Toronto and Vancouver has raised housing prices within an hour drive in every direction, so that even previously affordable communities are no longer so.

A New Housing Affordability Program From the Federal Government

For these reasons, the federal government decided to step-in.

Ottawa announced the First-Time Home Buyer Incentive in March, and recently clarified how it will work.

Essentially, the government hopes to make home buying more affordable by giving first-time home buyers an interest-free loan in exchange for equity in their property.

The program will provide up to 5 per cent of a resale home purchase price, or up to 10 per cent toward a new build.

To qualify, buyers must have a household income of less than $120,000 and must have saved up a 5 per-cent down payment on their own. Their mortgage must also be limited to four times their income, so must be capped at $480,000, for a total purchase price of $505,000.

In 25 years, or when the buyer sells the home, they will have to repay the loan as a percentage of the purchase price. The benefit to the program is that buyers with lower incomes will still be able to afford their monthly payments since they will be borrowing less than they would have otherwise.

The main issue though, is that the program’s low purchase price cap of just $550,000 is hardly enough to afford even a condo in any major city. In fact, Zoocasa estimates that there are few neighbourhoods in Toronto in which even a condo can be purchased for that price. (check out the infographic below to see exactly where).

The program is most likely to benefit residents of small towns, or in big cities in the prairies and eastern provinces.

Zoocasa.com is a real estate company that combines online search tools and a full-service brokerage to empower Canadians to buy or sell their homes faster, easier and more successfully. Home buyers can browse real estate listings on the website or the free iOS app.