By: Zoocasa

Mississauga is no longer a sleepy bedroom community near Toronto. It’s now a full-fledged city in its own right, with abundant jobs, a high population of over 730,000 residents and almost 8,500 property transactions every year.

It has become a boom town home to the headquarters of over 60 Fortune 500 companies and home to some of the most diverse communities in Canadas — new Canadians often bypass the City of Toronto and head due west, straight for Mississauga.

Are Mississauga Home Prices Still Affordable?

But with this kind of strong demand comes a price — a million dollar price to be exact.

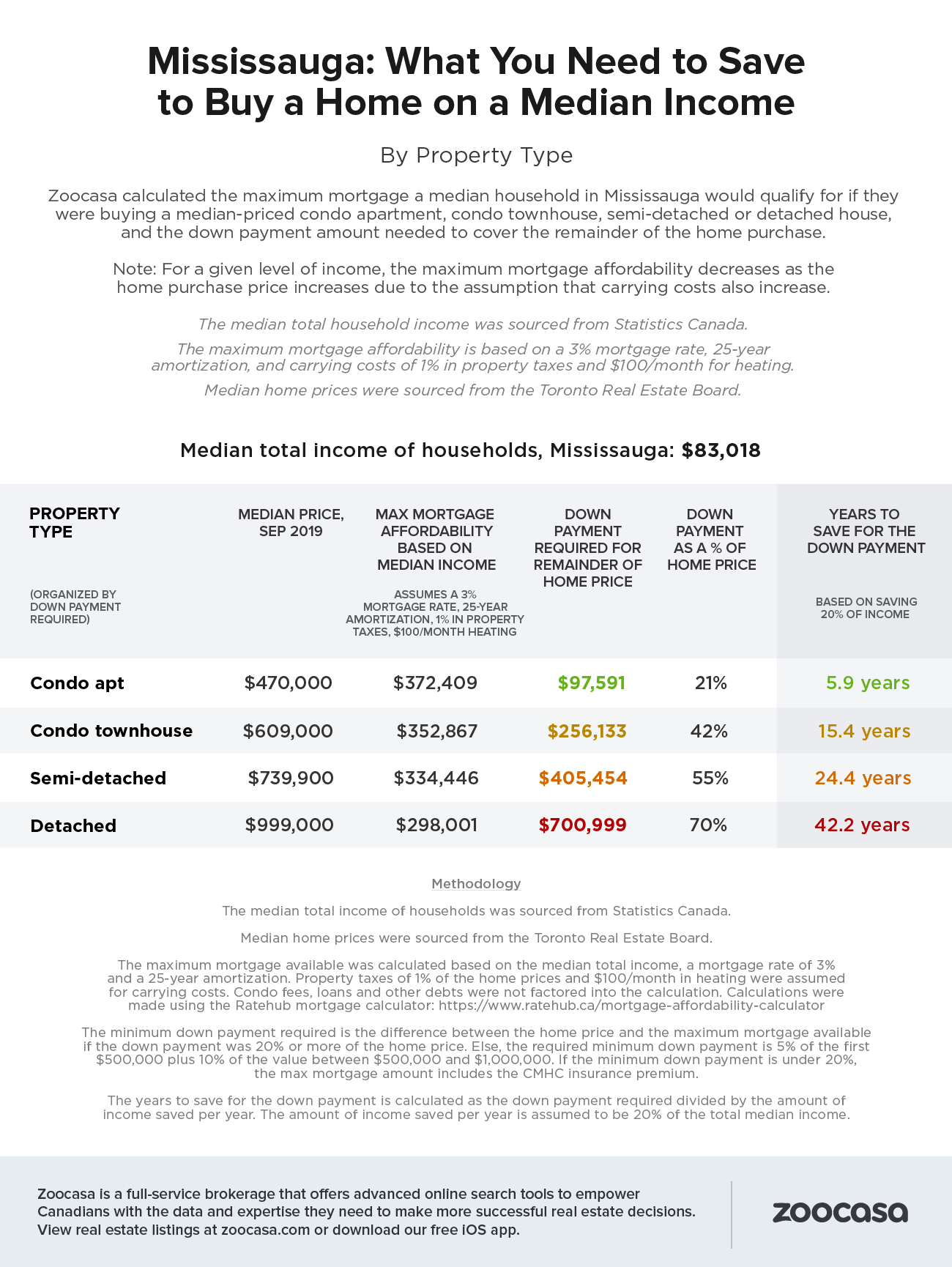

Homes for sale in Mississauga range from $470 for Mississauga condos to $609,000 for condo townhouses, to $739,900 for semi-detached to a whopping $1 million for a single

Zoocasa recently reported that a household with the city’s median income would not be able to purchase median-priced real estate of any kind without having to save for years, if not decades, to gather the necessary down payment funds.

The study sourced median income data from Statistics Canada, and median housing prices from the Toronto Real Estate Board. To determine the maximum mortgage amount for households they assumed a 3% interest rate over 25 years, plus 1% of the home’s purchase price for property taxes, and a $100 heating bill. Condo maintenance fees were left out of the equation as they vary considerably in each building.

Detached Houses Out of Reach for Median-Income Buyers

What they found is that the median household income of families who live in Mississauga is just $83,018. At that income, the most a household could afford to borrow on a detached house of $1 million is $298,001. So in order to afford to purchase a detached house, families must gather together a down payment of $700,999. If a household saved 20% of their salary, a figure recommended by most personal finance experts, it would take an incredible 42.2 years to save for a Mississauga down payment.

Mississauga Condos More in Line with Local Median Incomes

While a condo is technically more affordable, it would still take the median-income household almost six years to save up an appropriate down payment of $97,591.

One solution is to make more money — not an easy or feasible one for most. The second solution is to save more than 20% a year — also a hard one when there’s so many line items tugging at our budgets each month. The third solution is to partner up with friends or family to purchase a residence, although few want to take this route. The fourth is to choose a less expensive property type, like a condo unit over a single family home. And the fifth is obviously to move to a less expensive location — also difficult if family and jobs are in a single place.

Ultimately, saving up for a down payment in Mississauga is a daunting task.

Check out the infographic for detailed information on how many years it will take to save up a down payment per housing type: