By: Zoocasa

The road to becoming an official homeowner is often a stressful one, especially as the weeks leading up to closing day require many moving parts. Upon closing day, before the property ownership and title gets transferred from the seller to the buyer, a few payments are required. These costs include the down payment, mortgage loan insurance and its applicable PST, land transfer tax, title insurance, legal fees, and other miscellaneous costs.

Let’s take a look at these final closing costs, and break down what home buyers can expect to pay out of pocket before their home transactions closes.

Down Payment

In Canada, buyers looking to purchase a home priced at $500,000 or less are required to pay a minimum of 5% of the purchase price. Homes with a purchase price between $500,000 to $999,000 must pay 5% of the first $500,000 of the purchase price and an additional 10% of the portion above $500,000. For homes priced at $1 million or more, buyers are required to put down a minimum of 20% of the purchase price.

Mortgage Loan Insurance and Insurance PST

A mortgage loan insurance is required from home buyers putting a down payment of less than 20% of the home purchase price. This insurance protects lenders should the homeowner default on their home loan. While it can be paid in full on closing day, it is usually just added on to the monthly mortgage payments. Using a mortgage calculator is a good way to estimate what you can expect to pay monthly for homes that you are considering.

A PST of 8% is also charged on the mortgage loan insurance and is due at the time of closing.

Land Transfer Tax (LTT)

Home buyers who look to purchase a home, condo, or land in Ontario are subject to a provincial land transfer tax. The rates for this tax are as follows:

- Amounts up to and including $55,000: 0.5%

- Amounts from $55,000.01 to $250,000: 1.0%

- Amounts from $250,000.01 to $400,000: 1.5%

- Amounts from $400,000.01 to $2,000,000: 2.0%

- Amounts over $2,000,000: 2.5%

First-time home buyers in Ontario are eligible for a rebate of up to $4,000 on land transfer taxes.

It’s also important to note that properties in the City of Toronto are also subject to a municipal land transfer tax (MLTT) and follows the same rate structure as the provincial tax. First-time home buyers in Toronto can also receive a rebate of up to $4,475.

Legal Fees, Title Insurance, and Miscellaneous Costs

Additional one-time fees that could be added to your closing day costs include purchasing title insurance, registering the mortgage, and the transfer of property.

Those looking to build a brand-new home are also subject to a 13% HST but can receive provincial rebates depending on the end value of their home.

Average Closing Costs Across Ontario

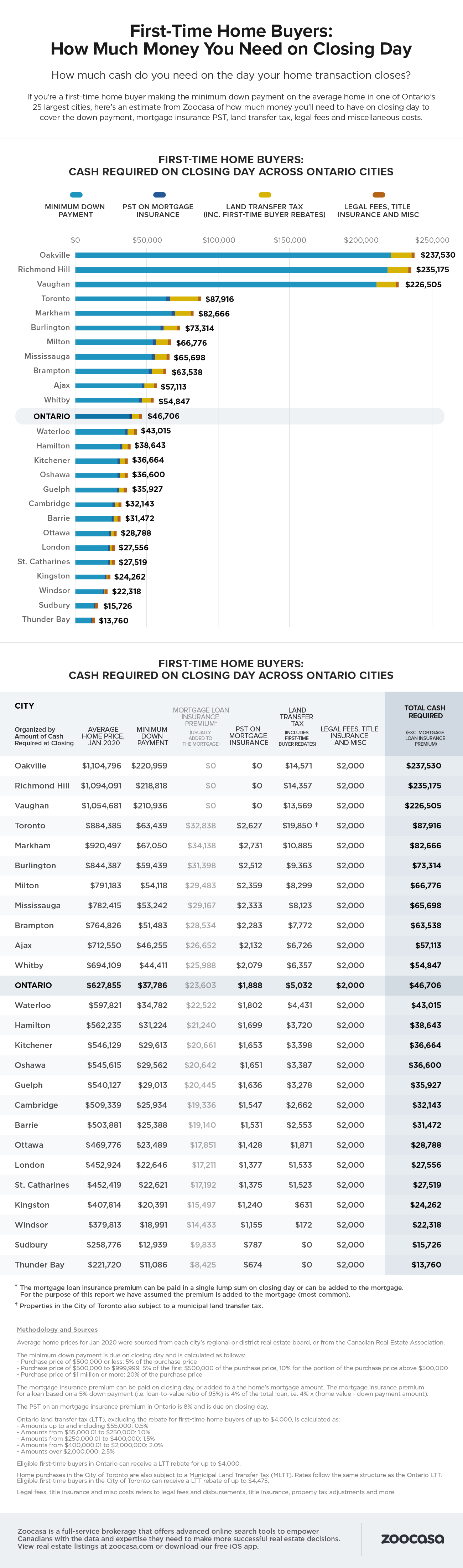

Zoocasa gathered information from the 25 largest cities in Ontario to estimate what first-time home buyers can expect to pay on closing day. These calculations assume that the minimum down payment has been made, land transfer tax rebates have been applied, and that mortgage default insurance costs have been added to monthly mortgage payments rather than being paid in full on closing day.

According to the report, on average, Oakville real estate has the highest closing day costs in Ontario. With an average home price of $1,104,796, the minimum 20% down payment required in Oakville falls at $220,959. Adding the land transfer tax as well as legal and other miscellaneous fees estimated at $2,000 brings closing day costs for Oakville residents to $237,530. Richmond Hill and Vaughan follow close behind with closing costs of $235,175 and $226,505, respectively.

The City of Toronto is fourth on the list in highest closing day costs with Toronto real estate listings averaging $884,385 in home prices which requires a minimum down payment of $63,439. Even after first-time home buyer rebates are deducted from the total closing costs, as Toronto is subject to both an LTT and an MLTT, Toronto residents face the highest total LTT at $19,850, leading to an average total closing cost of $87,916.

Take a look at the infographic below to see how much first-time home buyers in other Ontario cities can expect to pay in closing day costs if they were to purchase an average-priced home.